What We Offer

Our philosophy is to focus on the creation of long-lasting, mutually beneficial relationships with our clientele of families, high-net-worth professionals and small businesses.

Partnership

- We differentiate our service through a consultative, collaborative approach that allows our clients to be totally engaged in the development of their financial plan. Our interests will always be aligned with our clients. We succeed as you succeed, and we will work with you and your financial team to ensure success.

Knowledge

- We approach every decision we make with thoughtfulness and analytical rigor. And while we hold over 35 years of industry experience, we also challenge conventional wisdom to discover new insights and new ways of providing value to our clients.

Respect

- We are guided by fairness, honesty, and integrity. These principles serve as a foundation for how our associates engage clients and each other.

- Wealth Management 80%

- Financial Planning 60%

- Risk Management 40%

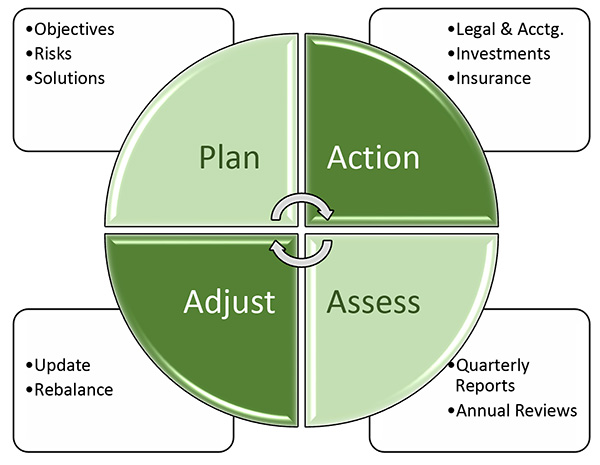

Our Work Flow

Listen

We listen. Wherever you may be in life’s journey; just starting out, raising a family, putting children through college, pursuing growth in your profession, planning for retirement, what is most important to you where you are at today?

What are your concerns and priorities?

Plan

According to Benjamin Franklin, “… nothing can be said to be certain, except death and taxes.” Developing an effective financial plan requires a profound understanding of risk and reward and the tools and techniques that are most effective to mitigate risk and maximize the potential for your success.

In order to reach your goals, how much risk are you willing to assume? Our tools, based upon Nobel Prize winning techniques, quantify the answer to this question rather than depend upon subjective opinions.

Working together with our clients and their advisers we develop goal-based plans that are effective, economically efficient and understood.

Action

Assess

Adjust

Plans are reviewed and updated annually or as changes occur in a client’s circumstances. When it comes to answering questions or addressing client concerns, we are never closed.

Clients are welcome and encouraged to call us at any time.

Frequently Asked Questions

What is a Fiduciary?

A fiduciary is a person or organization that manages money or property for someone else and has a legal duty to act in the client’s best interests. A financial fiduciary must avoid conflicts of interest, disclose any potential benefits they may receive from their recommendations, and follow certain rules and regulations. As a Registered Investment Advisor, our firm, and our representatives, are by definition fiduciaries.

As a fiduciary, we uphold the highest standards of trust, integrity, and loyalty. We provide objective and unbiased advice, ensuring that our recommendations align with your goals and values. With our expertise and experience, we navigate the complex world of wealth management, financial planning, and risk management to create customized strategies that maximize your financial potential. At Vantage Point Wealth Management, LLC, we are committed to building long-lasting relationships based on mutual respect and partnership.

How are you compensated?

Our firm uses a hybrid compensation structure.

Wherever possible, our preference is for products and services that are commission-free.

We provide wealth management services are provided on fee-basis. Each client has the opportunity to select a fee schedule that best suits their personal circumstances and objectives. Advisory fees are then deducted from their accounts monthly based on the value of assets under management (AUM). Wealth Management is provided in the context of a financial planning process. Therefore, we do not assess a separate fee for financial planning services we perform for our wealth management clients.

In the area of risk management, insurance products have traditionally been distributed through insurance agents who are paid commissions and for some products, ongoing annual service fees. With the increasing number of investment advisors who prefer using commission-free products, there are a limited, but increasing number of insurance companies that have created products that are designed to be distributed through fee-based investment advisors.

Upon a full review of product structure, pricing, guarantees and growth opportunities – if we determine that a product that pays commissions is a better value for your individual needs, we will always show you both the commission-free alternative and the commissioned product with full disclosure of commissions to allow you to make an informed decision regarding the manner in which you wish to implement your plan.

How do you assess risk?

There are many different kinds of risk that we take into consideration, but when most people think of risk they are reflecting on their concerns about whether their investments might lose value.

Each person has a different perspective on risk based on many factors, age, income, current savings, etc. We evaluate risk from the following perspectives:

- Given your personal income, expenses and current assets, how much capacity do you have to take risk.

- Given your individual temperament, what is your tolerance for volatility in portfolio returns from year-to-year.

- Finally, we assess your composure when faced with uncertainty.

These three components are combined to form a risk score. Your risk score, taken together with the rate-of-return that must be achieved to meet your objectives is used to develop individualized investment portfolio recommendations. We focus on achieving goals with the smallest amount of risk. We are not focused on portfolio performance relative to market indexes, only on how the portfolio is performing relative to your goals.

Why are you independent?

An advisor can work with a broker-dealer or insurance company as either a career representative or as an independent broker/agent.

By working with a company as a career representative one receives many valuable benefits. A national marketing campaign promoting the company and its services, brand recognition, office space, support staff, health insurance, life & disability insurance, pension plans, 401(k) plans, etc.

But with that affiliation comes the requirement to meet sales production requirements. For an example, a typical insurance company might require their agents to generate $3,500 each month in new sales commissions. A broker-dealer might require $10,000 per month in commissions or $1,000,000 in new assets for the firm to manage each month. Having a contract with a broker-dealer or insurance company to operate an office for that firm often comes with a requirement to generate $500,000 in commissions for that company through the office each year.

In addition, these employment contracts can define the insurance agent as a captive agent, required to only offer their company’s products whether or not there might be a better product to meet their customer’s needs.

The issue then is conflict-of-interest. As a registered representative for a broker-dealer firm, do I focus on selling the firm’s proprietary products in order to receive higher commissions to meet production requirements? With an insurance company, might I sell my company’s products in order to receive higher compensation (e.g. qualifying for travel awards, higher pension matching contributions, higher expense reimbursements, etc.) even if another company’s product would be a better match?

One of our greatest concerns is that our clients know that we are making the best possible recommendation, one that is not influenced by requirements to meet sales quotas or earn commissions. Therefore, we decided long ago to operate as an independent firm. As a result, we do not receive fringe benefits, but we sleep well knowing that we can always help our clients with the best products available to meet their needs and circumstances.

How do you communicate with clients?

Because our clients are located in several states, it isn’t always practical to show up to a face-to-face meeting on 30 minutes notice. Fortunately, we live in an age where technology constantly progresses to improve the ability to communicate when and wherever you happen to be.

In addition to one-on-one meetings, we use email, teleconferencing, video conferencing, screen sharing technologies, etc.

Our software systems are highly integrated. Clients can login to the client portal to access all of their financial accounts (bank, broker-dealer, insurance company, lenders, etc.) and see how they are progressing towards meeting their goals. Clients can edit their accounts or add new accounts.

A secure, military grade document vault to save and share important documents such as account statements, trust documents, tax returns, etc. between the client and their advisor.

Clients can interact with their financial plan through a graphical and intuitive interface, with the impact of changes instantly displayed.

Our offices are never closed. Clients are welcome to contact us at anytime day or night.

Don't Be Shy

Drop us a line anytime, and we will respond to you as soon as possible